October 2021, #1

This week we discuss the Bitcoin rally, Ethereum price action, part 2 of trading systems, E-naira postponement and Zoom-In on FTX Token (FTT) and Curve DAO Token (CRV)

This Week.

1. Bitcoin retests local top, Ethereum PA

2. Getting your trading system right (Part 2)

3. E-naira postponed

3. Zoom-In: FTX Token (FTT) and Curve DAO Token (CRV)

Dear reader,

Thank you for subscribing to eCoinomics. We appreciate your readership and hope you are here with us for many more issues.

When we thought about writing a weekly newsletter, we weren’t thinking about an audience. It was more about reminding ourselves to stay the course and not act against our sober minds once money was on the line.

It’s a reminder not to FOMO or be afraid to take a trade because we fear price might dump past what would have been a good entry. So in a way, that’s exactly what you get by reading eCoinomics.

We discuss macro technical and fundamental analysis away from low time frame noise that helps build a long-term trading mentality. You also get news and we discuss the projects we are looking at for the week in the Zoom-In section.

These are essentially letters to ourselves and we hope you can gain some useful insights every time you read them.

You may contact us for any reason at ecoinomicsweekly@gmail.com. We host a twitter spaces session called #CryptoRoundUpAfrica with some of our best buds on Twitter every Thursday at 10 PM WAT. Follow us @avogroovy, @oloye__ If you missed any of the Twitter live sessions, check out the podcast at https://linktr.ee/cryptoroundupafrica

The eCoinomics team.

Bitcoin retests local top.

A question I have seen asked a lot on the TL is, Why is Bitcoin ripping and alts bleeding?

My friend Emeka, puts it best. “Funds are moving from alts to BTC.”

That is Bitcoin dominance in effect. We wrote a bit on this in one of our August issues.

This is asides from the fact that Bitcoin at resistance is not a good place for new alt longs. So most traders are taking a risk-off approach. The more likely thesis is that the rally has been led by spot buys hence Bitcoin is still returning a neutral funding rate at the time of writing, which means the rally is not being led by overleveraged degens. That is healthy for the price.

All this to say, more traders are reallocating to Bitcoin and once Bitcoin settles and starts sideways choppy action, alts are expected to pump harder.

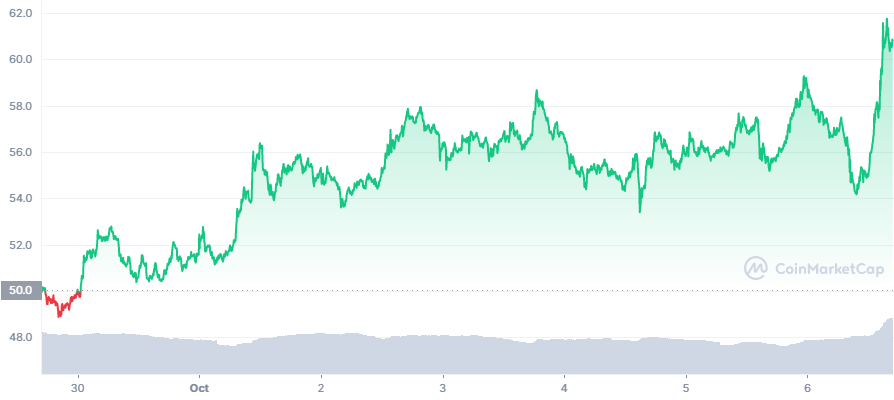

PA-speaking, (PA*price action) Bitcoin is retesting its August top at $53000 from where the market broke down before. A daily close anywhere around this price is bullish, generally speaking, as long as we continue to close above $45000, we are good.

If this level gets rejected, then we’d like to see $40000 hold to keep the bullish market structure in place.

A weekly close above $53000 means we’d likely see a retest of the $60000 level before the new ATH towards the end of the year. But for the sake of alts, we hope Bitcoin goes into price discovery sooner rather than later.

For Bitcoin bulls though. So far, so good.

ETH/BTC

Most alts follow Ethereum price action. This means when we analyse the strength of alts we usually look at the ETH/BTC chart. And right now it doesn’t look good.

A Bitcoin led recovery is good news, not just while it’s in the actual state of recovery.

Ethereum is currently trading at multi-timeframe support of 0.0654 BTC after failing to break 0.07 BTC resistance.

The levels we are looking at for this chart are 0.064, 0.061 BTC if it breaks current support which likely translates to alts taking more beating. Above the current price, once BTC starts to chop sideways, we expect Ethereum to retest the 0.07BTC level.

For its USD pair, we expect ETH to hold $3000 as long as Bitcoin doesn’t break below $45000. These are the important areas of support. We are looking to open longs if reclaimed $3500 support holds. This makes sense from an R: R POV because of close invalidation and the upside could be a new ATH.

2. Getting your trading system right (Part 2)

…..contd

2. Don’t trade against the trend.

Find a directional bias, find support, find resistance, then stick with it until proven otherwise.

We often confuse “expert opinions” and “celebrity punditry” with alpha. It’s not going to move price just because you read it on Coinbase. Do you know why? Because other people read it before you and already front ran you.

Many people become crypto news junkies because they are looking for information they think will enable them to outsmart the market, but that’s often not the case for very simple reasons.

i. The efficient market hypothesis posits that every public information that can move price has already been priced in. Other people have already seen the news, read the same columns and listened to the same experts. So this kind of information doesn’t offer a long term edge.

ii. The translation of an event, forecast, or news item is purely subjective as it assumes, we will make a correct analysis. We often don’t. Even when we do, we may lack the conviction to see it through when that green and red line starts to flash across the screen.

iii. Emotions built off this information results in tunnel vision for most traders which leads to not being able to see or consider anything except the bias they have built of new items and “expert forecasts.” The fear/greed that emotions trigger is a sure way to making bad trading decisions.

“Price action is the main alpha.”

The only objective measure of a token or coin is its price action. It reflects the path of least resistance of a price based on market consensus and sentiment. Price movement can be random, even irrational. If you trade against the dominant trend, you can be taken out very fast. Price action can stay irrational far longer than you can stay liquid. So it’s best to err on the path of least resistance and trade the trend until a reversal in trend.

3. E-naira….

Nigeria’s flagship Central Digital Currency (CBDC), E-naira has been postponed as the project failed to launch as earlier planned by Nigeria’s Central Bank.

The Central Bank of Nigeria’s effort at creating a CBDC is commendable as it is a signal that the bank is embracing financial technology as a means of financial inclusion for all and making access to digital payments easier.

The E-naira will serve as a legal tender and medium of exchange (one E-naira= one Naira note). However, the recent challenges encountered in the failure to successfully launch call into question the competence of the bank at delivering on a critical national economic infrastructure.

CBN scored a victory recently to move ahead with the launch of the digital currency in a trademark infringement lawsuit brought against her by ENaira Payment Solutions Limited. Justice Taiwo Abayomi Taiwo of Federal High Court 8 sitting at Abuja ruled that the CBN can go ahead with the launch of E-naira in the interest of the country, however the substantive motion restraining the launch of the E-naira was not struck out which leaves room for speculation on the final outcome of the lawsuit.

A major difference between E-naira and privately issued digital currencies and assets is that the Central Bank can mint an unlimited number of currencies according to its fiscal and monetary policies. Considering how opaque Nigeria’s fiscal policies are, the level of distrust by Nigerians for the apex bank digital currency increases as the bank has a lesser degree of difficulty minting several amounts of the E-naira into circulation which raises concern of higher inflation. It doesn’t help that the E-naira doesn’t exist in an open ledger system so it’s completely dark. For an institution struggling with a lack of trust, this doesn’t help.

Additionally, another major point of contention is privacy. The centralization of the digital currency means the bank has absolute control of the transaction ledger and blockchain and can see all transactions at all times which raises concerns of privacy.

The digital currency tiered wallets structure can also become an entry barrier.

Some also argue that contracting the infrastructure to a private company (Bitt Inc.) domiciled in Barbados is a national security risk which the country should not be taking on as it exposes a nation’s economic infrastructure to the danger of economic sabotage through backdoor codes that could be exploited.

4. Zoom-In: FTX Token (FTT) and Curve

DAO Token (CRV)

The crypto market looks healthy and green again while Bitcoin absolutely leads the way. Tokens on our spotlight this week are FTX token (FTT) and Curve DAO token (CRV). We have selected both tokens for the spotlight section this week because they have held their high time frame bullish structure intact while retesting critical areas of support.

FTT is currently sitting above reclaimed support and both monthly and weekly open which is a good sign of strength and interest from traders. Our thesis on FTT remains that it is a fundamentally strong project with a lot of use case and buzz at the moment and it is only a matter of time before it goes parabolic. Significant resistance around the $64 area as we’ve seen this area which was former all-time high become resistance. Price will have to break this area to see further upside. If rejected, $53 is a good buy zone where a lot of traders will be targeting entry.

Curve Finance (CRV) has not done much since the breakdown in May. It is still recovering and slowly grinding its way up. Price currently sits at $2.9 which is support and it is holding strong. There is strong resistance at $3.4 which would have to be broken for CRV to see further gains. The resistance area has been tapped multiple times which means supply/sellers in that region is reduced/weak and if enough buying volume comes in we expect this area to break and for the price to move up swiftly.

It is important to note that the altcoin market is still mostly dependent on what bitcoin does and the overall state of the market. If bitcoin remains relatively stable then we expect the spotlighted coins to perform well.

We are also happy to inform our readers that they can win an iPhone 13 and up to $150 USD if they sign up on bybit and deposit at least $5 in the bybit Independence Day Promo.

Create a bybit account with this link https://www.bybit.com/en-US/invite?ref=QJ2M33 and deposit at least 5USDT.

Find more information here and Ts&Cs: http://blog.bybit.com/en-us/announcements/events/independence-day-ng/

The contents herein are for educational, informational and entertainment purposes only. It should not be considered financial or investment advice. We are not financial advisers and have no experience in the field. Please talk to trained finance professional before making any investment decisions.