September 2021, #2

This week we discuss Bitcoin pullback, Ethereum's price action, Funding rates, Bitcoin Day in El Salvador and we spotlight Bonfida (FIDA).

eCoinomics Newsletter is a weekly publication that discusses technical and fundamental trends, macro thesis and newsworthy events around blockchain tech, crypto and digital assets.

This Week.

1. Bitcoin pullback, Ethereum is not our leader!

2. Funding rate for dummies.

3. Bitcoin Day in El Salvador.

3. Zoom-In: Bonfida (FIDA)

Dear readers,

Thank you for subscribing to eCoinomics. We appreciate your readership and hope you are here with us for many more issues.

When we thought about writing a weekly newsletter, we didn’t think about how you- the audience might receive it. It was more about reminding ourselves to stay the course and not act against our sober minds once money was on the line during the course of trading and those green and red symbols start flashing across our screens.

It’s a reminder not to FOMO or be afraid to take a trade because we fear price might dump past what would have been a good entry. So in a way, that’s exactly what you get by reading eCoinomics.

We discuss macro technical and fundamental analysis away from low time frame noise that helps build a long-term trading mentality. You also get news and we discuss the projects we are looking at for the week in the Zoom-In section.

These are essentially letters to ourselves and we hope you can gain some useful insights every time you read them. We are by no means gurus and you’ll see that just by how wrong we expect to be as we go along. But we promise to get better and you’re invited along for the journey.

You may contact us for any reason at ecoinomicsweekly@gmail.com. We host a twitter spaces session called #CryptoRoundUpAfrica with some of our best buds on Twitter every Thursday at 10 PM WAT. Follow us @avogroovy, @oloye__ If you miss the Twitter live sessions, check out the podcast at https://soundcloud.com/crypto-roundup

The eCoinomics team.

1. Bitcoin pulls back on “Bitcoin Day.”

On eCoinomics last week, we had a bold prediction and called this week’s dump even when it looked like Bitcoin was going to blitz our prediction and make us look like plebs. That would have been alright. Price though has done exactly what we predicted.

The purpose of our thesis last week was to leave as a reminder for ourselves not to overleverage and keep close eyes on our longs. Mission accomplished.

This week has seen Bitcoin price pullback below the September monthly open of $47300, currently trading at $46000 after making a weekly high of $52900. Bitcoin lost $10000 in a matter of hours on the same day it was officially adopted as legal tender in El Salvador. It dipped as low as $40000 on cryptocurrency exchange Houbi, outperforming our prediction of $42000 from last week’s issue.

Weekly support is $44000 and as long as that holds, our macro thesis on Bitcoin remains bullish. We already saw strong buying pressure below that price, but if more sellers, were to step in at the retest of the weekly structure at $53000, then our eyes are peeled in the $40000 zone.

Above the current range, $53000-$57000 remains our next trouble area. Beyond those price levels, we cannot make a case for sellers stepping in.

Staying true to our monthly thesis which suggests that BTC will close below the monthly open of $47000, we are not putting on our intraweek bull hats just yet.

1.1 Ethereum is not our leader!

Ethereum seemed to be leading what looked like a market-wide rally last week. It briefly touched $4000 before succumbing to Bitcoin’s price movement even though it had outperformed BTC in the days leading up to the dump.

This lends credence to our sentiment from last week that compared an Ethereum led market recovery to a game of musical chairs. While Ethereum is still subject to Bitcoin, it has held its own. Ethereum still looks strong. Although it lost $1000 in the pullback, it quickly reclaimed $3400 as support after it wick’d the $3000 weekly support and it has continued to trade above that price.

The thesis on ETH/USD is simple. We expect the $3100-$3400 demand zone to hold, below that level, there’s the $3000 weekly support and maximum pain support of $2600. Anything below that price means the market has gone to shit and alts will suffer. Above the current price, an S/R flip of $4000 into support is green light for a new all-time high.

2. Funding rate for dummies.

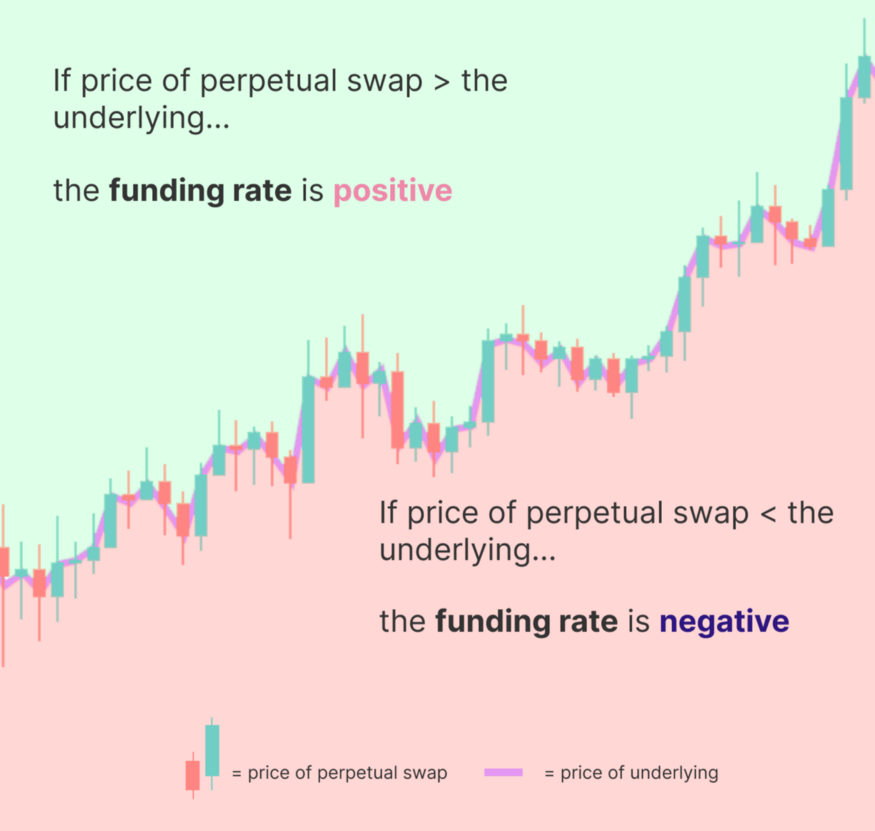

To understand perpetual futures contract funding rates, you need to understand how traditional futures contracts work.

The crypto market unlike the traditional market is open 24/7. In the traditional futures market, futures contracts expire at a specific date. This means at settlement, there’s a convergence between the spot and the futures price before new contracts are opened. Perpetual contracts have no closing date. They run “perpetually.” A position could be held forever as long as it isn’t liquidated.

This means, there are has to be a way to make futures price converge with the spot price of any asset even though it doesn’t have a closing date. Hence, funding rates.

When the spot price and the futures price of an asset differ, it means those purchasing the futures contract are either purchasing it at a discount (when perp price is lower), or at a premium (higher perp price.)

Funding rates is the difference between both prices.

Positive funding rates means, traders are bullish and most traders are buying longs. There’s a need for traders on the other side of the trade. This means longs are made to pay those willing to trade against them. It’s an incentive given to those who want to sell/short the contract. Also, it’s a way of discouraging too many traders from taking long positions thereby forcing perp price significantly higher than the spot price.

Negative funding rates means most traders trading a particular asset are shorting/selling. This results in a negative funding rate and shorts pay longs. What they pay is the funding rate.

Contango is the positive side of things, It means futures prices are trading at a premium for a sustained period of the, the opposite of this is called backwardation.

The intention of this is to have a mechanism that keeps futures price in line with the spot price. The higher the premium, the higher the funding.

When there’s too much unchecked premia on one side of a trade usually caused by overleveraging, what’s known as liquidation cascades may occur. This is when price moves aggressively in one direction like we witnessed yesterday. This forces traders out of their positions through liquidation and resets the funding rate. Funding rates are different across assets and exchanges.

Source: bybt.com

Black is neutral, red is positive and green is negative.

What does this mean for traders? Typically, a very high positive funding rate will lead to a bearish movement and vice versa. The longer the funding rate stays in the extreme, the better the signal. @SamTrabucco of Alameda research writes often on futures premia.

3. “Bitcoin day in El Salvador.”

On Tuesday 7th of September Bitcoin officially became a legal tender in El Salvador. In June, the country’s legislature passed a bill that recognizes Bitcoin as a legal tender thereby creating this week’s epoch-making even as it became the first country to make Bitcoin a national currency.

“Bitcoin Day” as dubbed by El Salvadorian President Nayib Bukele to mark the historic adoption was marred with huge price volatility to the downside as the price of Bitcoin dropped by $10000. The large drawdown in bitcoin price has drawn criticism from different quarters about the implication of a highly volatile currency on the economy of an underdeveloped nation and merchants who are forced to accept it. Additionally, critics have expressed displeasure about Article 7 of the Ley Bitcoin which mandates every economic agent to accept bitcoin as payment when offered for good or service. Critics argue that this law is antithetical to the ethos of bitcoin which promises financial freedom.

The President of the South American nation later announced that the country has acquired an additional 155 bitcoins when he tweeted “buying the dip” thereby bringing the total number of bitcoin in the nation’s reserve to 550 bitcoins.

3. Zoom-In: FIDA

This week we are seeing significant price dump and liquidation across the board on both majors and altcoins. A lot of coins that have reclaimed old bullish structures are currently struggling to find support due to the impact of the price crash witnessed on Tuesday.

This means we don’t have a high conviction for a lot of alts right now, as such, this week’s spotlight features only one token.

On our spotlight this week is Bonfida (FIDA). FIDA has been trending all week because projects built on Solana blockchain are gaining traction from traders and retail alike. FIDA is currently holding its bullish structure and looking for more upside. FIDA is one to keep an eye on as high time frame support sits at $6.2 and it will have to hold for this token to gain any upside due to the current market condition.

It is important to note that the altcoin market is still mostly dependent on what bitcoin does and the overall state of the market. If bitcoin remains relatively stable then we expect the spotlighted coins to perform well.

Honourable mention. Again! Solana (SOL)

The contents herein are for educational, informational and entertainment purposes only. It should not be considered financial or investment advice. We are not financial advisers and have no experience in the field. Please talk to trained finance professional before making any investment decisions.