September 2020, #1

This week we discuss Bitcoin and Ethereum PA, Nigeria's move to launch a CBDC, Cuba's move to legalize bitcoin, and spotlight Cardano (ADA) and Fetch.AI (FET)

This Week.

1. Bitcoin & Ethereum high time frame analysis. What’s next for both majors?

2. Nigeria to launch e-Naira wallet; Cuba moves to legalize Bitcoin.

3. Zoom-In: Cardano (ADA) and Fetch.AI (FET)

Dear readers,

Thank you for subscribing to eCoinomics. We appreciate your readership and hope you are here with us for many more issues.

When we thought about writing a weekly newsletter, we didn’t think about how you- the audience might receive it. It was more about reminding ourselves to stay the course and not act against our sober minds once money was on the line during the course of trading and those green and red symbols start flashing across our screens.

It’s a reminder to not FOMO or be afraid to take a trade because we fear price might dump past or pump past what would have been a good entry. So in a way, that’s exactly what you get by reading eCoinomics.

We discuss macro technical and fundamental analysis away from low time frame noise that helps build a long-term trading mentality. You also get news and we discuss the projects we are looking at for the week in the Zoom-In section.

These are letters to ourselves and we hope you can gain some useful insights every time you read them. We are by no means gurus and you’ll see that just by how wrong we expect to be as we go along. But we promise to get better and you’re invited along for the journey.

You may contact us for any reason at ecoinomicsweekly@gmail.com. We host a twitter spaces session called #CryptoRoundUpAfrica with some of our best buds on Twitter every Thursday at 10 PM WAT. Follow us @avogroovy, @oloye__. Subscribe to our substack: ecoinomicsweekly.substack.com. Telegram: t.me/ccswap

The eCoinomics team.

1. Bitcoin up or down?

There isn’t much excitement being generated by Bitcoin weekly charts nowadays. We put a lot of work into seeking out differences in the charts we post when we update you. This has forced us into attempting to front-run a bold call for Bitcoin this month. (Remember nothing you read here is financial advice and this is a note to ourselves just as much as they are to our readers.)

What is Bitcoin price most likely to do next? Against the advice of every crypto analyst that we respect, we are calling a retest of daily support at $44000 and likely retest of the 0.618 weekly fib line at $42000 thereafter.

There, I said it! My co-writer Anthony probably disagrees with me but at least that’s something to be excited about!

Two simple reasons for this.

1. Everyone on CT (Crypto Twitter) says we are going up.

2. BTC/USD monthly historical returns data.

BTC/USD Historical returns chart by bybt.com

Technical analysis is based on the assumption that the past can be used to predict the future. In the past ten years, September has returned 8 negative months and the only two which have been positive have been in single-digit, so if 2021 happens to be the third, at least we won’t be wrong by much. That also makes R: R sense.

Also, we have learnt to discount noise on Twitter. In May, when first nuked to $37000, most people called $100000 and rebuked anyone that dared say otherwise. The frenzy is similar now. But price has been hanging around support $46000 more than it’s been around resistance since we touched $50000. A general TA rule is, the more price touches any area, the more it’s likely to break that area.

The 4H Bollinger bands midpoint has also been flipped into resistance and has held. And while our last week charted local support has also held, we think it’s only a matter of time.

1.1 Ethereum’s show of strength.

Ethereum is finally testing our charted “trouble area” of its USD pair after weeks of consolidation. At the time of writing, ETH is trading at $3500. For emphasis, we are keeping the same levels from last week so that readers can observe the differences in price action. Last week, we said if sellers were to step in, it will be at this point.

Ethereum seems to be leading a market recovery which we consider weaker than a Bitcoin led recovery. Bitcoin dominance took a hit this week but if our BTC thesis were to hold, that won’t be the case for much longer. This is a very interesting area for ETH and a weekly close at this level will make a bullish case for retesting Ethereum’s ATH as there isn’t much for resistance levels standing in its way.

We had a theory about ETH last week. We expected the NFT mania to pump EHT price and that looks to be the case now. Ethereum’s Arbitrum roll-up which aims to provide a solution for high transaction cost and implement faster speed also makes a bullish case for ETH. This roll-up comes as ETH struggles to ward off L1 protocols like Solana (SOL) and Avalanche (AVAX) which have also seen significant price rallies.

It’s hard to make a case for ETH without Bitcoin. And while Ethereum continues to show strength, a short position makes more R: R sense now because the invalidation level is close and until $3500 gets flipped into support, we are not going to assume that that will be the case. Also keeping in mind that it’s a historically negative month for BTC.

2. Nigeria to launch e-Naira wallet; Cuba moves to legalize Bitcoin.

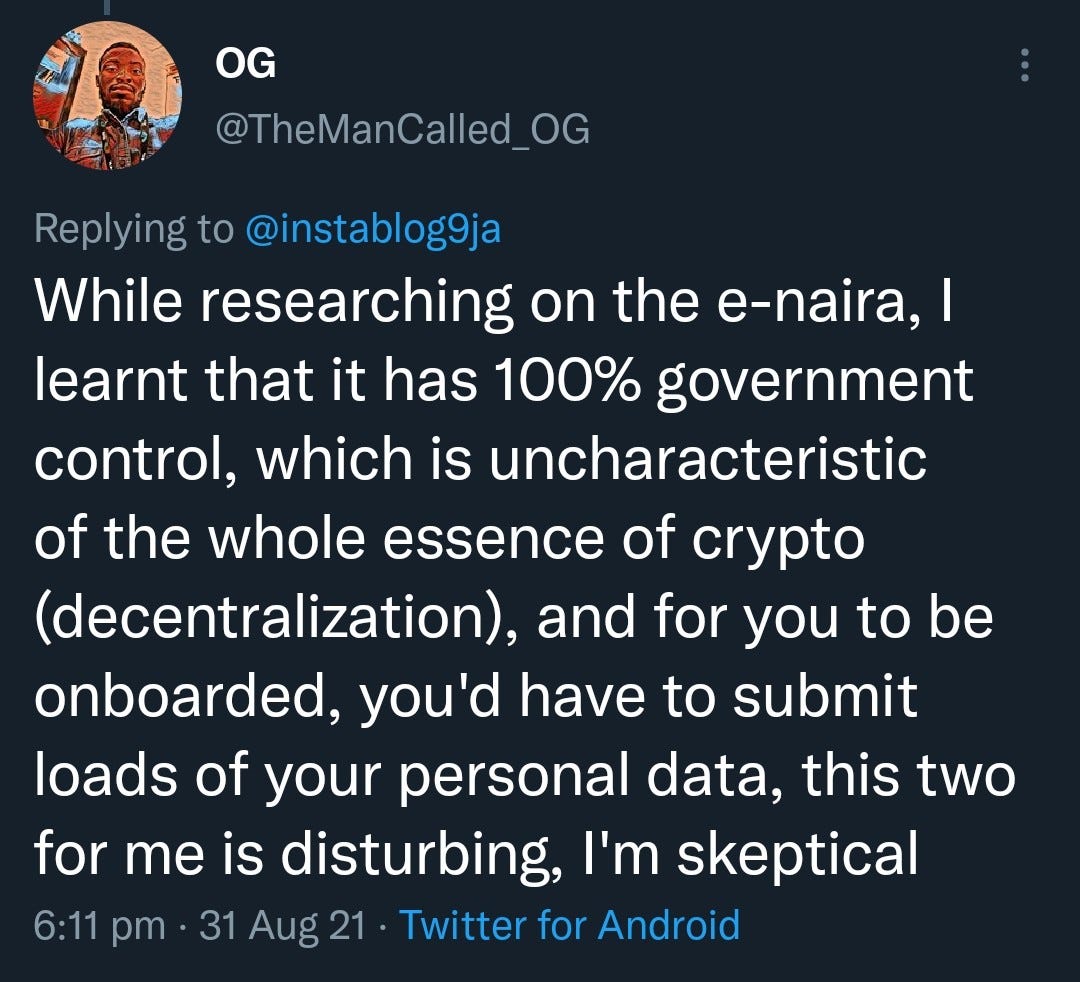

The Central Bank of Nigeria (CBN) this week unveiled plans for Nigeria’s own Central Bank Digital Currency (CBDC) guidelines. The apex bank revealed guidelines on how the digital naira (e-Naira) will be regulated, designed and issued according to nairametrics.

The CBN plans to issue a three-tiered “Speed Wallet” with different transaction limits and Know Your Customer (KYC) requirements as part of the rollout. Each wallet it claims will come with no transaction or maintenance charge. The Central Bank is scheduled to launch the e-Naira on the 1st of October and it will be accepted as a legal tender as stated in its memo to banks in the country.

In a similar development, the government of Cuba has announced plans to authorize, regulate and recognize cryptocurrencies as legal tender joining its Caribbean neighbours El Salvador. According to Euronews, the Cuban government published a resolution in its official gazette that empowers the Central Bank to set rules for cryptocurrencies use in socio-economic and commercial activities within Cuba.

The resolution will become official on September 15th while the Central bank will continue working out regulatory frameworks. Bitcoin has become a popular form of digital payment on the Island nation as tourists and crypto-savvy citizens use it as a means of exchange and diaspora Cubans use it for remittance to skirt sanctions due to the economic embargo placed on Cuba by the USA.

3. Zoom-In: ADA and FET

In the August issue of eCoinomics, we spotlighted Solana (SOL.) We noted how it had maintained its high time frame bullish structure while consolidating before the run-up that led to the eventual breakout of SOL. This has brought renewed interest to the entire Solana ecosystem. This is often the case when a section leader rallies, traders who missed out on the move buy into associated tokens to catch the move on those.

This week, tokens in our spotlight are Cardano (ADA) and Fetch.AI (FET). Both coins have maintained their bullish structure the past few weeks. FET in particular is printing green candles with increased trading volume and volatility the past few days. ADA is more interesting because the upgrade of the Alonzo hard fork is only days away. Traders have an incentive to push the price of ADA up and buy any pullback at support in order to profit off the momentum of smart contracts finally launching on Cardano.

Cardano is currently sitting at support and we expect a breakout towards the current All-Time High (ATH) price of $2.97 and then go into price discovery of $4.50. If there are more sellers at current price then $2.4 should offer some relief as support for ADA. FET has just blitzed through resistance and awaiting a successful retest. Upon confirmation of resistance/support flip, the sky is clear for a move to challenge the previous ATH of $0.87.

It is important to note that the altcoin market is still mostly dependent on what bitcoin price does and the overall state of the market. If bitcoin remains relatively stable then we expect the spotlighted coins to perform well.

The contents herein are for educational, informational and entertainment purposes only. It should not be considered financial or investment advice. We are not financial advisers and have no experience in the field. Please talk to a trained finance professional before making any investment decisions.