November 2021, #2

We discuss BTC and ETH PA, we complete our crash course on trading R/S, how to DYOR and briefly discuss market sectors we think will outperform others in 2022.

This Week.

1. Bitcoin and Ethereum retest weekly support.

2. Crash course on support and resistance. (Read a book)

3. How to DYOR. (Do Your Own Research.)

4. Zoom-Out. (Market sectors we are looking at for 2022.)

Dear reader,

Thank you for subscribing to eCoinomics. We appreciate your readership and hope you are here with us for many more issues.

When we thought about writing a weekly newsletter, we weren’t thinking about an audience. It was more about reminding ourselves to stay the course and not act against our sober minds once money was on the line.

It’s a reminder not to FOMO or be afraid to take a trade because we fear price might dump past what would have been a good entry. So in a way, that’s exactly what you get by reading eCoinomics.

We discuss macro technical and fundamental analysis away from low time frame noise that helps build a long-term trading mentality. You also get news and we discuss the projects we are looking at for the week in the Zoom-In section.

These are essentially letters to ourselves and we hope you can gain some useful insights every time you read them.

You may contact us for any reason at ecoinomicsweekly@gmail.com. We host a twitter spaces session called #CryptoRoundUpAfrica with some of our best buds on Twitter every Thursday at 10 PM WAT. Follow us @avogroovy, @oloye__ If you missed any of the Twitter live sessions, check out the podcast at https://linktr.ee/cryptoroundupafrica

The eCoinomics team.

1. Bitcoin retests weekly support.

The professor: So, Bitcoin will breakout at $66000 to create a new ATH, and return to the multi-timeframe support at $58000. Then break out again to form another ATH at $69000

Helsinki: Then it rallies to $100000?

The professor: No, that is where Biden’s Infrastructure bill comes in.

And here we are again, retesting weekly/daily timeframe.

Liquidation figures have been insignificant so we cannot make a case for a market reset just yet. What is happening looks more like aggressive profit-taking. While it’s not necessary that a liquidation cascade is required to reset the market before a new rally, it’s just ironically more healthy for Bitcoin price.

The infrastructure bill getting signed into law (which has far-reaching effects judging by its definition of who “brokers” are) coupled with already high leverage has resulted in a double fake breakout. The chances of a third fake breakout are less likely than that of a breakthrough.

Multiple daily closes above weekly support of $58000 keep our bullish play in act. A weekly close below “Max Pain Support” around $50000 is what it’ll take to flip bearish.

For now, we are watching for a daily close below $58000 which we think will lead to a retest of the $50000 level on the weekly.

How do we play this?

Obviously buy another retest of $58000 with the hope of retesting resistance at ATH. It makes more risk:return sense as invalidation is a daily close below that price.

Set stink bids between $52000-$50000 where a lower high market structure will be confirmed.

In summary, levels we are watching; $58000 on the daily, $50000-$52000 on the weekly time frame.

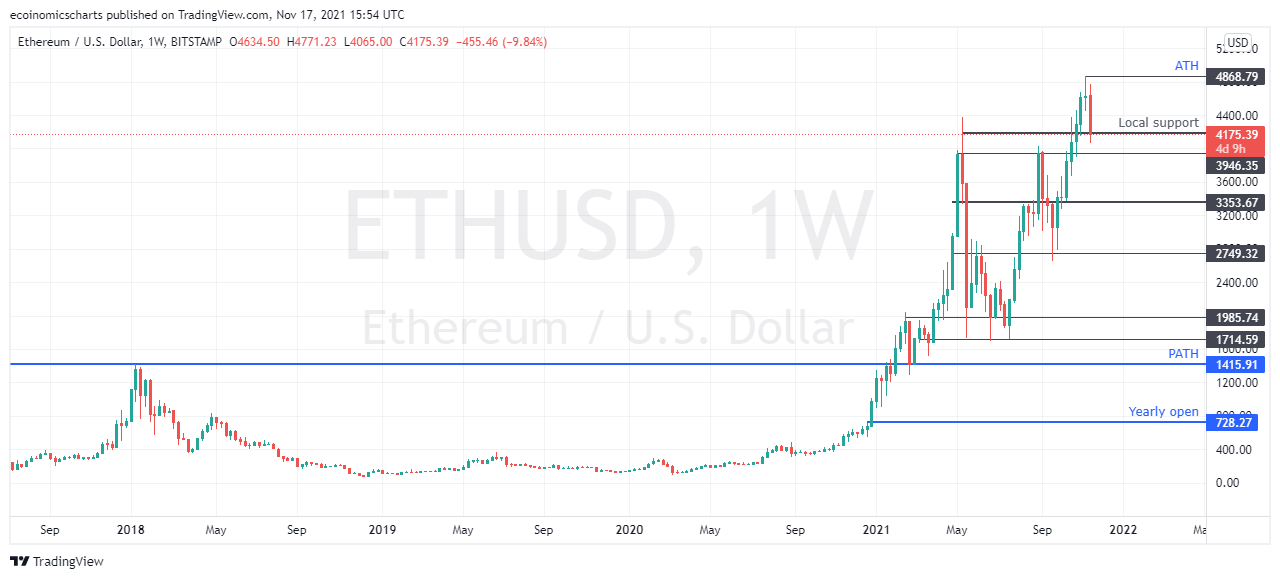

ETH/USD

Ethereum took the slow route to a new ATH, grinding up slowly. But once it started falling. It fell hard and fast reaching a low of $4000, its previous break-out price after reaching a new ATH at $4800.

This is similar to the Bitcoin $60000 level. A daily close above $4000 keeps our bullish case intact, a close below that level and we are catching knives all the way to $3600.

Again, it makes sense to buy at $4000 because invalidation is very close. If support gets rejected, we punt bids between $3600 and $3000 and see how many get filled.

And although price made a lower low on the daily, we think this is more descriptive of the distrust for Eth’s price action.

In summary. Daily close > $4000 (good=buy), <$4000 (bad=punt orders between $3600-$3000)

2. A crash course on trading support and resistance.

You can read more about it in my Intro to Futures Trading Book here

To avoid being too repetitive, how about you just go read more on trading support and resistance in the book and let’s get to other things that haven’t already been addressed.

3. How to DYOR (Do Your Own Research)

This writing is inspired by a conversation we had recently in response to a question on Twitter spaces about what criteria determine which tokens we buy and hold. This is not an exhaustive list, it is also not applicable to day traders (only long term holders) neither is any of this financial advice. You know the drill.

Intuition: This is your best asset. If you’re convinced about the project and your intuition says go ahead then do it. That is the boring answer. And not to sound too philosophical, you kinda sorta know when something sounds like it makes sense.

Sector: This is where the power of your imagination becomes important. What do you foresee happening in blockchain technology within the next decade? Do you think NFTs will pop, does the Metaverse sound like it’ll gain large scale adoption, would Defi make a return? Of course, we are assuming you already know what all these things are.

What sectors do you think will be big and achieve global adoption? It could be supply chain, privacy tools, distributed cloud computing, centralized/decentralized exchanges, DeFi, base layer protocols, metaverse, NFT, Oracles, DAO’s etc. Narrow it down, then do research on the sector leaders.

Team: Do you know the people behind the project? How good is the team, their competence, training, education, technical ability and experience? What field are the team members experts in and how convinced are you in their ability to deliver cutting edge, groundbreaking and revolutionary technological products in a constantly evolving ecosystem? Many venture capitalists recently bought AXS at double-digit figures this year, our hunch is that they are mostly basing their investment thesis on the assumption that the Axie Infinity team can continue to build better games that captures more users and growth which will lead to an increase in the token price.

Technology: How novel, significant or game-changing is this project and what they are building? What makes it different from the existing products on the market? Is it is something new that tackles an existing problem that no other project has addressed properly? All these would make the final decision easier.

Venture Capitalists: This can be a double-edged sword. Some VCs just want to buy cheap tokens at seed stage and dump them on retail without contributing any value to the project. However, there are some VCs that actually care about adding value to the ecosystem and actively support the team, community and participate in the governance of the project. A venture crowded project could mean doom and could also mean the project is great but it’s best to err on the side of caution on these types of projects. Check at what price VC’s bought their seed tokens on (icoprice.com) just to know how many “x” returns they’ve amassed and what is the likelihood of them selling immediately tokens are unlocked. A project without VC investment could mean it is a fair launch project or nobody finds the tech compelling enough so exercise caution on that end too.

Tokenomics/vesting: This is an integral and important part of valuing a project. What is the maximum supply, what is the current circulating supply? what is the current market cap and fully diluted market cap just to have a sense of potential future returns and foreseeable growth - crunch the numbers and be realistic (Compare it to already established projects in its sector and see if the numbers make sense). Additionally, what percentage of the token was sold to VCs? What percentage is going to the team and advisors? More importantly, the vesting schedule. How many tokens have been released to VCs/ Team/Advisors? When will more tokens be released? What is the emission schedule? E.g Serum has a 7 years linear vesting schedule for team/advisors and VC - that tells us that only long-term minded, reputable and value-adding VCs who are there for the tech will agree to have their tokens vested (locked) for 7 years.

Roadmap: What is the project roadmap? What point of the roadmap are they currently in and what more is coming. It is highly recommended to read the whitepaper to figure this out and reading the whitepaper helps you decide if the project is garbage, underwhelming and over-promising or not.

Exchanges: What are the exchanges the project is listed on? At least it should be a tier 1 or decent tier 2 exchange with a good amount of liquidity. If it is some obscure website no one’s ever heard of, it’s most likely illiquid and will not make it to the mainstream or get you may get rugged. Many good projects launch on decentralized exchanges, however, be cautious as anyone can launch a token on a DEX make sure the team is doxxed (they are not anonymous.)

Price Action: Price action is king. It shows you the market sentiment of both buyers and sellers. Many people neglect this part but it is good to pay attention to it to know if you’re buying an asset at a fair market value. Another advantage is that the price action can help you form an opinion on what direction a project is going especially if it has been in a perpetual downtrend for weeks/months which should make you ask yourself if the risk:reward ratio is worth it. Ask yourself always - at what price did the token launch and what is the current price?

Lastly, one of the greatest strengths of blockchain technology is the pseudonymous yet openness and public nature of the blockchain ledger. With this basic function, you can search on a token explorer page for wallets with the most tokens of a project and how long they’ve held the tokens, what price they bought it and how many they’ve sold. That will help you ascertain how early you are in the project and mitigate the likelihood of sell pressure.

Remember to always do your due diligence before you go ahead with putting your hard-earned money into an asset. Good luck!

If this sounds like a lot of homework, it’s called DYOR for a reason.

4. Zoom-Out

Instead of “Zooming In” this week we have decided to “Zoom Out” in order to look at the bigger picture and get a sense of where we currently are and what is to come in the space.

This is going to be a shorter version of a much longer market thesis which we will flesh out as we publish more issues. We hope to cover the sectors we think will outperform others next year.

Recently, Facebook announced its pivot into the Metaverse. Many VC funds are also raising funds to support blockchain tech. We are bullish on blockchain tech long term because of the immense human resources and talent making a transition to building within the space.

Looking at the current landscape of how development, narratives, project funding are playing out, we posit that decentralized derivatives exchanges, Zero-Knowledge rollups (privacy), Layer 0/Layer 1 and Layer 2, Web 3.0 ( web infrastructure, social token, computation), Blockchain gaming, NFT/metaverse and cross-chain interoperability will witness immense growth in 2022

We recommend that readers pay attention to these sectors and make efforts to understand them.

We will also be here to help you on the journey to understanding them and helping you position to take advantage early.

The contents herein are for educational, informational and entertainment purposes only. It should not be considered financial or investment advice. We are not financial advisers and have no experience in the field. Please talk to trained finance professional before making any investment decisions.