December 2022, #1.

This week.

Bitcoin and Ether v USD. (Squiqqly lines on a chart 📈)

Have a Fed-ry good Xmas. (Santa Jerome Powell Claus 🎅🏽)

Contago Extraordinaire. (BlockFi bites the dust 💥)

The future is multi-chain. (Bitcoin as Abuja, Ethereum- Lagos. Polygon- Ogun 🌆)

1. Majors v Dollar.

Bitcoin reclaims $17,000. That’s good, right? No, you tell me. Right?

Here’s my half-baked theory of last week’s price action.

Bitcoin made a low of $15,400 last week. It has since reclaimed that level and currently trades at $17,000. This, I believe is partly down to the Fed chairman's delivering some expected good news. We’ll get to that in detail later.

The reclaim of this zone has Bitcoin primed to test $19,000. Barring any FTX.com best impressions anytime soon, we believe the $19,000 breakdown level is due for a retest.

Bitcoin continues to consolidate at the current level.

The good thing about this level is that Bitcoin seems to have established a midpoint between $19,000 resistance and $14,000 support. Any breakdown from the current level provides clear invalidation and we expect the next support to be found at $14,000.

The blue line in chart* has held. We expect movement towards the red line beneath or above it.

It can go up or it can down…

Ether holds monthly support.

ETH/Dollar closed above its local support at $1,100 for the month. If you believe in omens, that’s a good one.

The M.O. for Ether has been for it to act like leveraged Bitcoin. When Bitcoin loses 5%, it loses 10%. That is now an old narrative. Ether is currently 2% higher than Bitcoin when measured from All-Time-High. Losing 73% of its value compared to BTC’s 75%. At its lowest, it lost 81% from ATH, compared to Bitcoin’s 77%. So, not too shabby.

A lot of good things are happening in the Ethereum ecosystem. From NFTs to L2s like Polygon and Optimism. ETH Maxis have a lot to be optimistic about concerning the future of Ethereum.

If you’re not an Ether Maxi yet, you will become one. - Darth Vader.

$1,300-$1,500 is the level that Ether must reclaim to see more upside and $1,100 remains the support.

2. Have a Fed-ry good Xmas.

In several past issues, we have paid a lot of attention to and written about what’s going on at the Fed.

We believe the current market will be swayed more by macro than by drawing squiggly lines on a chart and hoping for the self-fulfilling prophecy that is technical analysis.

Fundamentals> Technicals. (In a bear market.)

This Wednesday, the Fed chairman appeared, at least in tone to be softening up. He acknowledged the long and “uncertain lags” of monetary policy: “The full effects of our rapid tightening so far are yet to be felt.” Powell said.

That’s much better than, “2% or we war.” This is a reference to the Fed’s target of bringing inflation down to pre-pandemic levels of 2%.

“It makes sense to moderate the pace of our rate increases.” He continued.

The markets immediately reacted positively with NASDAQ rallying 4.4% on the same day.

The markets responded positively to this as this signalled a possible lower interest rate hike in December from 0.75bps to 0.50bps.

For the uninitiated, here’s an oversimplification of why all these matters.

During the pandemic, the money printing machines went brrrrrr. And interest rate were lowered to allow cheaper access to capital by businesses.

More $ bills were printed out of thin air in the usual fashion of the Fed. Or since the post-gold standard.

This led to a lot of new money in circulation demanding fewer goods. Ultimately, this led to inflation.

Inflation is not good because it devalues the value of the currency. More money chasing fewer goods. Too much liquidity in the market.

This led to inflation at levels that had not been seen in decades peaking at over 9%.

What followed in response is what is known as Quantitative tightening. The purpose of this is to suck liquidity out of the market.

How Quantitative Tightening (QT) may impact investors.

Long story short, inflation is back at 7.7%. We get the sense that inflation has peaked.

With a lower 0.50 bps increase in December instead of the 0.75% interest rate hike, the market can see a short-term relief in December.

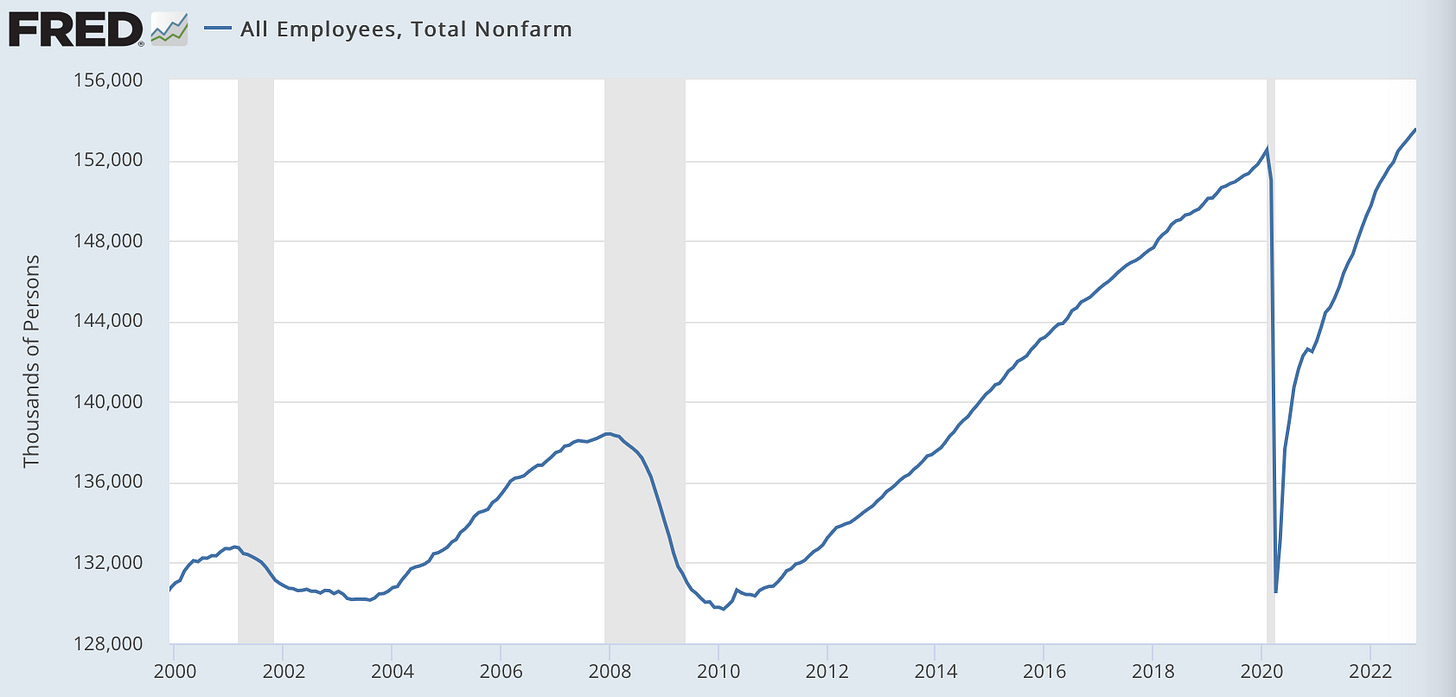

A statistical recession by definition means 2 consecutive quarters of negative GDP which is already the case. But actual inflation means unemployment at 6% or above. Currently, it’s only at 3%.

So we look to the jobs data for a clearer insight.

Total nonfarm payroll employment increased by 263,000 in November, and the unemployment rate was unchanged at 3.7 percent, the U.S. Bureau of Labor Statistics reported today. *2nd Dec 2022*

Notable job gains occurred in leisure and hospitality, health care, and government.

Employment declined in retail trade and in transportation and warehousing.The American economy continues to create more jobs. So QT may continue for much longer at a lower rate.

This is all in the short-mid term.

As we previously reported, major world economies are projected to enter recessions next year. 10-20 year treasury yield which tracks the bond market has inverted this year signalling a pending recession. Which is not good for your favourite Ponzi crypto token. As more companies will be forced to lay off employees in response to interest rates at the highest peak. It’s already happening.

So at $10k BTC is still on the table. Don’t get carried away.

But we’ll enjoy these Fed-ry good Xmas for now.

Important dates to watch out for in December.

Unemployment data: 2nd December.

Inflation CPI report: 13th December.

Fed interest rate decision: 14th December. (We expect a lot of volatility on this day so watch out.)

Holiday Rally? December 23rd-Jan 4th.

Happy holidays guys. We’ll be here to guide you through all these so if you haven’t subscribed. You know what to do.

3. Contago Extraordinaire.

Crypto lender BlockFi has filed for Chapter 11 bankruptcy. That was only a matter of time as the FTX contagion continues to grow.

It’s not so far-fetched that the “bailout” FTX provided was through FTT tokens.

When FTX was the new big kid on the block saving everyone from bankruptcy, those were worth around $25/FTT. But now that it has declared bankruptcy itself, they are worth just a little more than a dollar. Not enough to save anyone who had accepted it as money.

This story reminds me of a childhood friend who wasn’t so proud of the house he lived in. So he didn’t want any of his mates to come to visit.

He achieved this by convincing all of us that he had a big dog that bites everyone in sight and that the dog only listens to his dad. He mentioned that every chain that was bought to try to keep the dog from biting visitors was broken off by the dog before lunging at the unfortunate fellow in its sight.

He was very convincing so we never went to visit like we’ll do with everyone else’s houses in the group for fear of the wicked dog.

We later found out that my friend’s family didn’t own a dog.

But the threat of it was enough to keep us away.

It’s the same story with FTX. Bailing everyone else out by extending a credit they didn’t have meant its own house was never suspected of needing saving. So no one went looking because they postured that they were good for it.

The bank run that had caused BlockFi to need an emergency bailout ended because its depositors believed FTX was big enough to cover their assets. So they stopped withdrawing.

Like my friend’s imaginary dog, like FTX’s fictitious assets.

If you can convince the world that you have a nuke, maybe you never have to fire it. 🤷🏽

4. Blockchains as cities.

Everyone who lives in Lagos and those who carry out transactions on Ethereum have something in common. They complain about how expensive it’s to live in and do business in the city.

And then you have a city like Sango-Ota in Ogun state which by virtue of its closeness to Lagos, get people who work in Lagos but cannot afford to live in the city to move there. This is an example of a layer 2 (L2) like Polygon.

Bitcoin is more comparable to Abuja. It’s the block-state capital.

In this analogy, Ibadan would be Avalanche (AVAX.) Another city which offers its own peculiar living experience. Known for cheapness and ease of doing business.

They are all cities. They all offer different benefits and come with varying costs.

This is what I imagine our future to look like in the blockchain.

While it’s costly to do business on Ethereum, L2 help solve that problem. A better road/rail network which links Ogun to Lagos will facilitate more relocations to Ogun state. This is what L2 aim to provide for L1s like Ethereum.

Lagos is home to some of the hottest attractions, it’s the financial capital of the country, i.e. it has the highest TVL (total locked value: a sum of all the value of crypto assets deposited in a protocol.)

Its major drawdown like Ethereum is that it’s costly to afford a place in Lagos. It’s costly to build and because of limited space, there are major building projects that require reclaiming land from the ocean to build which creates more room for more people to move into the city.

Those who cannot a place afford it but want to do business in Lagos still might find themselves in Ogun state due to its proximity to Lagos. And that’s exactly what protocols like Polygon, (MATIC ) Arbitrum and Optimism (OP) do. The main goal of these protocols is to solve the transaction speed and scaling difficulties that major cryptocurrency networks/cities frequently face. Making it cheaper to do business in Lagos/Ethereum.

While all these cities exist, most people will find themselves moving between them for different reasons. So it’s important that there are real and rail networks that help them do that which is what bridges in the blockchain ecosystem do.

That’s the future of the blockchain. Multi-chain.

Different blockchains in their own rights and participants are able to move around through road networks (bridges on the blockchain that let users move their digital assets from one chain to another.)

Phantom recently announced that they would now support Ethereum and Polygon in addition to their native Solana. What this makes clear is that blockchain and the web3 ecosystem are working towards a multi-chain future where interoperability is the default setting.

There’s no need to argue over which protocols will be the winners. Just like there’s no need to write a post-mortem on one city because another one is being built.

Each part is connected by a bridge, to become one beautiful country.

Thank you for reading.

For comments, feedback and ad inquiries, kindly write to us at ecoinomicsweekly@gmail.com.

Groovy and Oloye for CryptoRoundUpAfrica ®️

Till next time.

🔌

Follow us on Twitter.

Like us on Facebook.

Connect on LinkedIn.