August 2021, #2

This week we discuss, Bitcoin and Ethereum PA, Visa's buy into NTFs, what Bitcoin dominance means for alts, and Zoom-In on Reserve Rights (RSR) and Swipe (SXP)

This Week.

1. Bitcoin shows strength.

2. Visa buys into NFT

3. Bitcoin dominance v Altcoins.

3. Zoom-In: Reserve Rights (RSR) and Swipe (SXP)

Dear readers,

Thank you for subscribing to eCoinomics. We appreciate your readership and hope you are here with us for many more issues.

When we thought about writing a weekly newsletter, we didn’t think about how you- the audience might receive it. It was more about reminding ourselves to stay the course and not act against our sober minds once money was on the line during the course of trading and those green and red symbols start flashing across our screens.

It’s a reminder not to FOMO or be afraid to take a trade because we fear price might dump past what would have been a good entry. So in a way, that’s exactly what you get by reading eCoinomics.

We discuss macro technical and fundamental analysis away from low time frame noise that helps build a long-term mentality trading wise. You also get news and we discuss the projects we are looking at for the week in the Zoom-In section.

These are letters to ourselves and we hope you can gain some useful insights every time you read them. We are by no means gurus and you’ll see that just by how wrong we expect to be as we go along. But we promise to get better and you’re invited along for the journey.

You may contact us for any reason at ecoinomicsweekly@gmail.com. We host a twitter spaces session called #CryptoRoundUpAfrica with some of our best buds on Twitter every Thursday at 10 PM WAT. Follow us @avogroovy, @oloye__. Subscribe to our substack:ecoinomicsweekly.substack.com. Telegram t.me/ccswap

The eCoinomics team.

1. Bitcoin shows strength.

Bitcoin has continued to show strength, rallying to a multi-month high of $50500. That’s the main difference between our analysis last week and this week. The level of resistance to break remains $53000-$55000 from where we expect it to rally to a new ATH. We cannot make a case for sellers stepping in above that range.

Analysis of on-chain activity shows some minor profit taking by long-term holders. This hasn’t put too much sell pressure on price as Bitcoin continues to trade above its local support of $44000.

Long term holders moving Bitcoin into exchanges increased this week. We have two theories for why this happened.

1. Profit-taking which puts sell pressure on price.

2. Buying of ETH to purchase NFTs which puts sell pressure on BTC price, but buy pressure on ETH.

This is comparable to what happened in Dec 2020 to April 2021 bull market and it is expected behaviour.

Where does that leave us with price?

Our macro thesis remains the same as last week. The important levels still haven’t been touched. Buying now doesn’t make a lot of sense technically speaking. We don’t like to assume that a level will be broken until it is broken. We also bear in mind that BTC option contracts expire on Friday which means we’re expecting some volatility.

We would love to tell you in what direction, unfortunately, we cannot see the future, and we can only tell you what we see.

What we see is that $53000 resistance is yet to be broken and $44k support is yet to be retested. These are the levels we want to trade. Hopefully, we have a clearer picture next week. So once again, we will err on the side of caution till we have a definitive retest of support or reclaim or resistance.

1.1 Ethereum in consolidation.

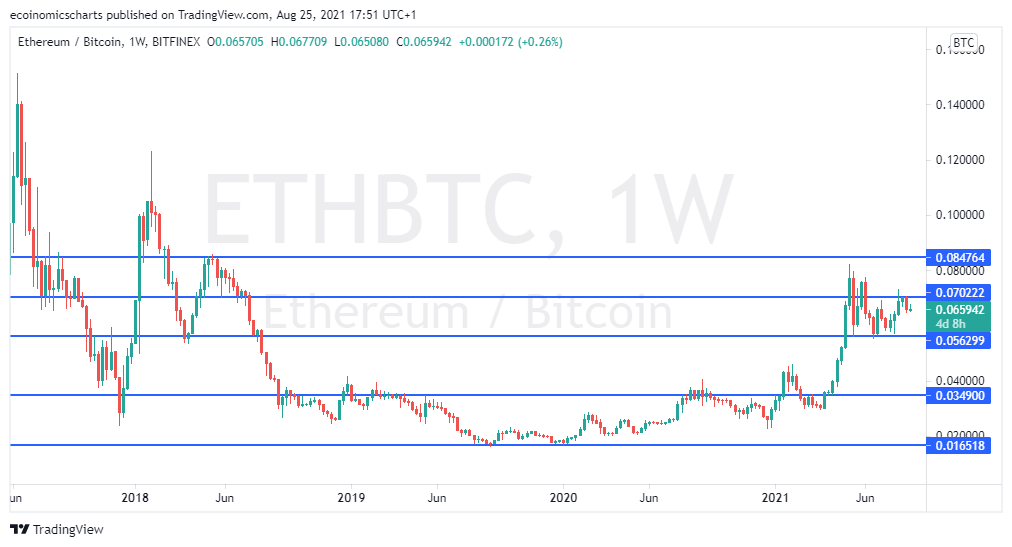

There is not much to see here. We had two theories for why long-term holders have been moving Bitcoin on-chain. The ETH/BTC pair disproves our second theory. Ethereum has only continued to consolidate below resistance on both BTC and USD pairs.

From a trading perspective, opening longs at resistance is hustling backwards because of the potential downside involved. Support is far away. Sellers might step in anywhere at the next trouble area $3300-$3500. You should long support and sell resistance. We didn’t make the rules.

For now, resistance continues to hold. Local support is at $2900. If BTC option contracts expiration proves to be a bearish event, we expect Bitcoin dominance to result in sell pressure on ETH price at which point we expect local support on both majors to break. Relevant support levels become $40000 for Bitcoin and $2300 for Ethereum.

Fundamentally, both majors look strong. They are just at prices where it doesn’t make sense to leverage.

2. Visa buys into NFT

Global payment and commerce giant Visa Inc. stepped into the NFT world this week when it announced the acquisition of CryptoPunk 7610 – a female punk worth almost $150,000. Visa’s Head of Crypto, Cuy Sheffield told The Block, “NFT’s are an intersection of culture and commerce.” and, “Visa is seeing pretty significant interest from merchants, brands, and content platforms that are looking to participate in the NFT space. So, now we're committing to starting to help clients navigate ways that they can participate in the NFT commerce ecosystem.”

What does this piece of news mean for NFT and blockchain technology generally? Visa Inc. getting into the space further solidifies market sentiment that NFT’s are going mainstream and institutions. At least that’s what institutional adoption suggests. This acquisition signals the legitimization of NFT/Metaverse and crypto at large as this is viewed as a big deal and precipitates mass adoption by more institutions. This acquisition by Visa shows the payment processor may have futuristic plans in the works to delve into NFT commerce which involves processing payment.

Source: NonFungible. https://nonfungible.com/market/history

Fortune Magazine auctioned a collection of NFTs which raked in $1.3 million and also made NFT art its August cover picture. The popularity of pay to play NFT game, Axie Infinity (AXS) has made it the highest revenue-generating protocol in the crypto market for the last two months. The NFT mania has led to an increase in trading volume of games, JPEG’s, penguins, NFT rocks and cryptopunks built on the blockchain due to adoption by market participants as well as influx of creatives into the NFT creator economy.

NFT fundamentals are easier to understand for the average person due to the subjective nature of art in general and they do not promise a grandiose utopia or manifesto to change the world like other crypto sectors. This is digital art and the value is determined by the subjective nature of artistic taste or value derived. Or the promise of being able to flip one into millions of dollars someday.

3. Bitcoin Dominance v Altcoins.

BTC Dominance $BTCDOM refers to what percentage of the cryptocurrency market cap is held by Bitcoin. Alts refer to every other asset in the crypto market asides from Bitcoin.

It helps us understand the flow of money in the market. Market cap is total price x circulating supply.

- If more money enters Bitcoin, it means more people are moving their equity to BTC.

- If more money enters alts, it means more people are moving to alts.

- If market the cap increases, it means more people are buying into the crypto market.

- If the market cap reduces, it means more people are leaving.

Bitcoin is the monetary standard of the crypto market. Until recently, pre stable coins, you had to buy Bitcoin to trade alt pairs. Bitcoin birthed the industry, the vision of its anonymous founder, its network effect and its secure nature due to its proof of work standard means most people trust BTC and use its strength to judge the crypto market. This is why when Bitcoin price is rising and adjudged to be strong, the trust is carried over into the market too and people can trust alts more. Same for when money is leaving the crypto market. Most people find safety in Bitcoin which puts selling pressure on alts prices. We had Crypto Cred on #CryptoRoundUpAfrica a few weeks ago and he told us to think of alts as leveraged Bitcoin. When Bitcoin pumps, they pump harder and when it dumps, they dump harder.

In essence, BTC Dominance is a function of cash flow. When a lot of cash flows into the market, alts perform and BTC dominance goes down, when money flows out, BTC dominance goes up as most Bitcoin is held by long-term holders who are not selling. This helps its market cap compared to alts.

4. Zoom-In: RSR and SXP

Our picks for last week’s issue of eCoinomics SOL & LUNA are not slowing down just yet. Solana and Luna are still maintaining their high time frame bullish structures. Solana looks like it is consolidating for the rally, while LUNA is printing new highs. Joining both LUNA and Solana last week as market leaders were Avalanche (AVAX).

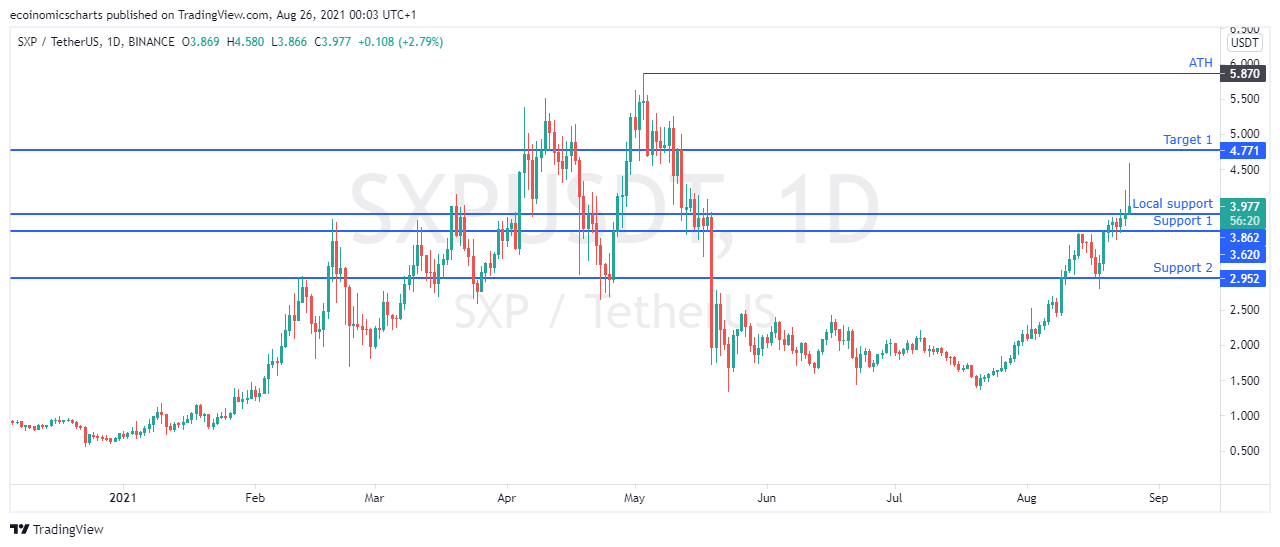

Tokens on our spotlight this week are Reserve Right (RSR) and Swipe (SXP). We have selected both tokens because they have held intact their high time frame bullish structure despite some profit-taking on Bitcoin. They are printing bullish candles, showing an uptick in strength, and increased volatility. Tokens that meet the above-listed metrics usually have a good risk: reward ratio (R: R) in the short to mid-term.

We expect Reserve Rights (RSR) to go retest the breakdown point of $0.064 which it lost in May. If bulls force price above the breakdown point then the next area of interest is $0.078. If the price gets rejected at the range high then $0.047 may be the area where buyers step in.

Swipe (SXP) is currently sitting above support. $4.7 is the next target up, if rejected then the next buy zone will be $3.6.

It is important to keep in mind that the altcoin market is still mostly dependent on what Bitcoin price does due to BTC dominance. If Bitcoin price keeps its bullish structure, then we expect the spotlighted coins to perform well.

The contents herein are for educational, informational and entertainment purposes only. It should not be considered financial or investment advice. We are not financial advisers and have no experience in the field. Please talk to trained finance professional before making any investment decisions.

Is it wise to buy into SOL now, or wait for a retrace ?