eCoinomics newsletter is a weekly publication that discusses technical and fundamental trends, macro thesis and newsworthy events around blockchain tech, crypto and digital assets.

August 2021, #1

This Week.

1. In this maiden edition of eCoinomics we discuss the technical trends surrounding Bitcoin/USD and Ethereum/USD.

2. Cardano (ADA) makes a triumphant entry into the top 3 market cap.

3. Zoom-In: Solana (SOL) and TerraLuna (LUNA).

Dear readers,

Thank you for subscribing to eCoinomics. We appreciate your readership and hope you are with us for many more issues. This is the maiden edition and just by reading it, you know it’s a late release. But we decided to release it anyway as most of the analyses in it are as true today as they were at the beginning of the week.

When we thought about writing a weekly newsletter, we didn’t think about how you- the audience might receive it. It was more about reminding ourselves to stay the course and not act against our sober minds once money is on the line during the course of trading and those green and red symbols start flashing across our screens.

It’s a reminder not to FOMO or be afraid to enter a trade because we fear price might dump past what would have been a good entry. So in a way, that’s exactly what you get by reading eCoinomics.

It discusses macro technical and fundamental analysis away from low time frame noise and helps build a long-term mentality trading wise. You also get news and we discuss the projects we are looking at for the week in the Zoom-In section.

These are letters to ourselves and we hope you can gain some useful insights every time you read them. We are by no means gurus and you’ll see that just by how wrong we expect ourselves to be as we go along. But we promise to get better and you’re invited along for the journey.

You may contact us for any reason at ecoinomicsweekly@gmail.com. We host a twitter spaces session called #CryptoRoundUpAfrica with some of our best buds on Twitter. Follow us @avogroovy, @oloye__. Subscribe to our substack @ ecoinomicsweekly.substack.com

The eCoinomics team.

1. Bitcoin hangs out at resistance.

Bitcoin has stayed a few hundred dollars shy of its next trouble area ($48800-$52000) having reached a recent daily high of $48100.

The current price at the time of writing is $45700 which makes it hard to make a bold call. $44500 is acting as support for now which makes sense once you look at the weekly trend line but until we see a retest of the clear daily structure at $42000, it’s hard to tell what price might do.

We don’t expect buyers to step in until a retest of $42k at least. Above the current price, we don’t expect sellers to step in until $52k.

The macro trend remains bullish, we haven’t seen a lower low yet, but we have seen a daily lower high. There’s no real volume expansion which suggests to us that price might stay in this range for a while.

We look to BTC options open interest (OI) data for some macro pointers. $55000 is the highest interest area at the moment with the highest number of contracts expiring Sep 24/21 according to coinoptionstrack.com. Going by this, we expect the price to enter the next trouble area before that date. The verdict is still out.

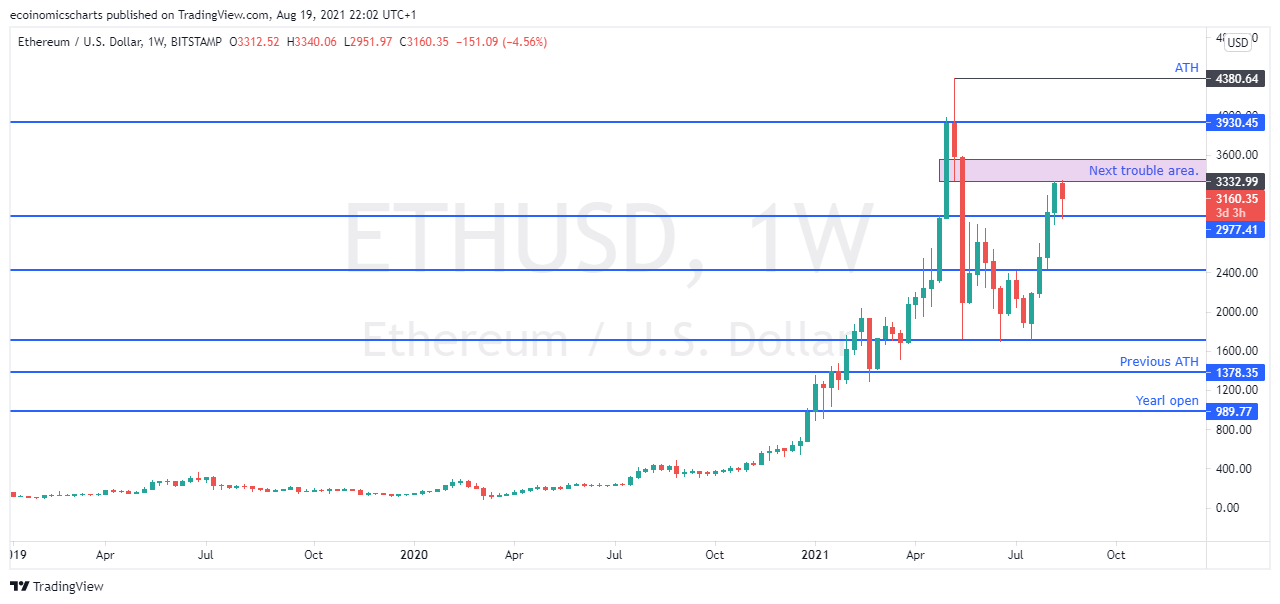

New EIP-1559, same ol’ Ethereum.

The goal of the Ethereum London hard fork EIP-1559 is to make transactions more reliable to price. It gives users one more decision to make when choosing how much to pay a miner to add a new transaction to the blockchain.

The sentiment on crypto twitter was that it was a sell the news event as it had already been priced in. It wasn’t. Price rallied on the day which signalled a bullish trend. Ethereum continued on its upward movement which started in late July only now stalling at $3300 mirroring Bitcoin $48000 resistance.

Our analysis of price action will err on the conservative side. Bitcoin dominance is still an issue for Eth and alts at large, so we can’t make a case for Ethereum that doesn’t factor in Bitcoin.

We expect Ethereum price to find support at $2400 just like we expect Bitcoin to find support at $42000 (confirming a lower high) if sellers were to step in at the next trouble area of $3500 and a sell-off were to happen. For now, we expect Ethereum to trade above $3000.

Resistance is not a good place to buy technically speaking as there’s more potential downside to that trade than upside from a R:R POV. Best to wait it out.

2. Cardano (ADA) makes a triumphant entry into the top 3 market cap.

coinmarketcap.com

The cards have been reshuffled and there is a new member at the top of the stack. Cardano (ADA) moved into the number 3 spot this week with a current market capitalization of $79.9 billion.

Cardano movement into the top 3 positions may not be unconnected to the recent rise in price brought about by the announcement of the upcoming Alonzo Hard Fork mainnet on September 12, by CEO Charles Hoskinson.

For four years, Cardano has promised a decentralized Proof of Stake blockchain platform that will revolutionize technological innovation globally. Cardano enthusiasts, critics and the community have endured the torturous wait for delivery of products and it is almost here.

2021 has been a very good year for Cardano as it has seen remarkable growth in price and is one of the best-performing assets. In the last few days, we have seen ADA price rally high breaking the $1.60 resistance and peaking at $2.2. It now remains to be seen if Cardano will print a new All-Time High (ATH) as capital is starting to flow into ADA due to retail euphoria brought about by the network effect ADA has generated over the years by onboarding new entrants into the crypto space. *ADA has broken its ATH. At the time of writing the above paragraph, it hadn’t.*

As long as Bitcoin continues to hold the $44,000 level of support, it is expected that ADA will enter into price discovery in the current market condition as the upgrade date gets closer. However, this comes with a caveat, price rallying could be another buy the rumour, sell the news event which is a common trend in crypto as people speculate about products launches and we see huge sell-offs when the actual product arrives.

3. Zoom-In: Solana (SOL) and TerraLuna (LUNA)

Solana (SOL)

TerraLuna (LUNA)

In the last few weeks, we have seen rallies in the NFT sector of the crypto market. NFT and Metaverse tokens have drawn enormous attention from market participants which have led to incredible gains in the sector. Axie Infinity (AXS) led and broke its own new highs every week while the rest of the market was sideways and choppy. Noticeable was the incredible amount of trading volume that AXS attracted when it led as it was the only outlier in the market.

Although AXS may have slowed down, Solana (SOL) and TerraLuna (LUNA) have taken off. Both tokens caught our eyes and are in our spotlight this week. SOL and LUNA have seen immense gains this week. Both of these tokens have broken their previous highs, shown incredible strength and have massive trading volume while Bitcoin and other majors are pulling back.

Our thesis from market observation is simple - follow the money. Traders are increasingly interested in trading tokens that show strength and have large trading volumes as it gives them an opportunity to choose a side in the market and enter into a trade.

Just like we saw with AXS, capital will continue to get reallocated into trending coins where traders think their interests are best served until Bitcoin ultimately decides where the market heads next.

The contents herein are for educational, informational and entertainment purposes only. It should not be considered financial or investment advice. We are not financial advisers and have no experience in the field. Please talk to trained finance professional before making any investment decisions.

Is it advisable to buy into SOL now, or wait for Retracement?

Thank you for this..

Looking forward to your next newsletter.